Self employed tax refund calculator

Return processing times vary depending on many factors including complexity of the return and our identity verification processes. 2022 Self-Employed Tax Calculator for 2023.

See Your Refund Before Filing With A Tax Refund Estimator

Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay.

. More information about the calculations performed is available on the details page. When it comes to paying income tax there arent any differences in the tax rates you pay compared with employees. You can use our income tax calculator to find out how much youll pay.

For the most up-to-date information concerning the status of your current year refund call 1-855-894-7391 or check our website then click on Wheres My Refund. Best Self-Employed Tax Software for Customer. You may even gift yourself a tax refund as a Christmas reward.

Yes No Student Loan Interest Tuition and Fees Form 1098-T. Our Self-Assessment guides and tips may help reduce the time spent on your return. TaxCaster Tax Calculator.

Yes No More Deductions. Self-Employed Health Care Premiums. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

Self Employed Tax Calculator 2022-2023 Self employment profits are subject to the same income taxes as those taken from employed people. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Best Low-Cost Tax Software for the Self-Employed.

This calculator is for 2022 Tax Returns due in 2023. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic.

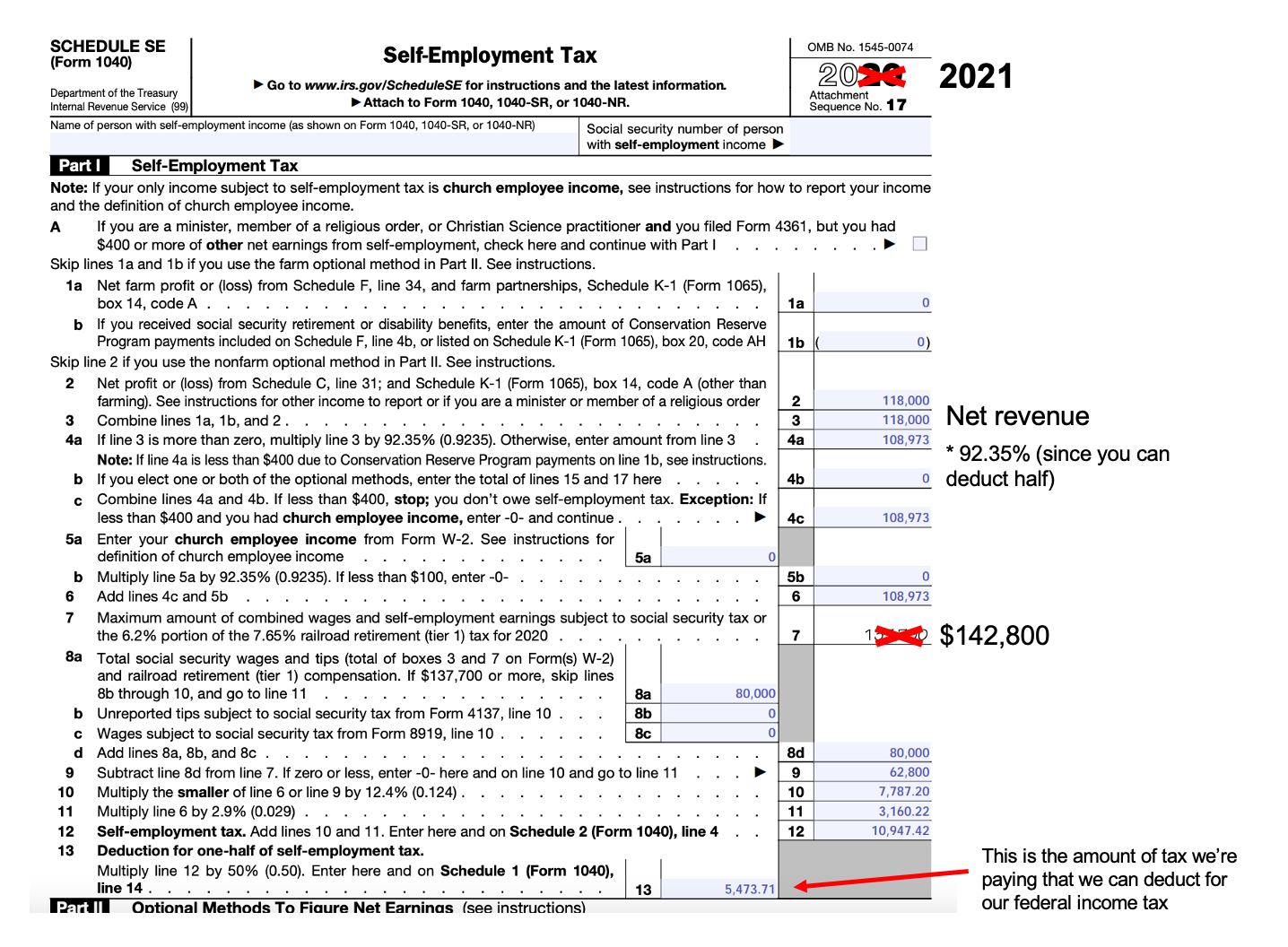

Please note that the self-employment tax is 124 for the Federal Insurance. Self-employed health insurance deduction Penalty on early withdrawal of savings Alimony paid b Recipients SSN IRA deduction. See what happens when you are both employed and self employed at the same time - with UK income tax National Insurance student loan and pension deductions.

In 2022-23 self-employed workers and employees pay. Statement from Alabama Department of Revenue. Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers.

It doesnt matter whether youre travelling via public transport or your own vehicle. The key difference is in two areas National Insurance Contributions and the ability to deduct expenses. Calculate your total tax due using the CO tax calculator update to include the 202223 tax brackets.

Get ideas on common industry-specific business expenses people in your profession use. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. TaxSlayer Self Employed.

Tax Guide to Going Self-Employed Becoming a Sole-Trader Our guide to the tax implications of branching out on your own. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results. 1 online tax filing solution for self-employed.

TurboTax Free customers are entitled to a payment of 999. Estimate your tax refund and where you stand Get started. 202223 Colorado State Tax Refund Calculator.

Yes No Alimony Paid. What are the self-employed income tax rates for 2022-23. Self-Employed defined as a return with a Schedule CC-EZ.

Use this calculator to estimate your self-employment taxes. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare. The calculator will provide a breakdown of earnings based on a full.

0 on the first 12570 you earn. Maximize your tax savings by estimating your business expenses. The self-employment tax rate is currently 153 of your income.

Discount available for the monthly price of QuickBooks Self-Employed Tax Bundle Bundle is for the first 3 months of service starting from date of enrollment followed by the then-current fee for the service. Claims must be submitted within sixty 60 days of. 2021 Tax Calculator to Estimate Your 2022 Tax Refund.

Normally these taxes are withheld by your employer. The deductible portion of your SE tax from your Form 1040 return Schedule 1 on the line for deductible part of self-employment tax and. Easily calculate your tax rate to make smart financial decisions.

Your account will automatically be charged on a monthly basis until you cancel. It only takes a few moments to use the rebate calculator. However if you are self-employed operate a farm or are a church employee you may owe self-employment taxes.

Deduct the amount of tax paid from the tax calculation to. If your net church employee income or total church income subject to self-employed tax is under 100 you will not owe any self-employment taxes. Just tell us a bit about the work and mileage youre doing and whether youre self-employed or working PAYE.

The amount of your own not your employees retirement plan contribution from your Form 1040 return Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans. Using the RIFT tax rebate calculator to work out your tax.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Income Tax Calculator Calculatorscanada Ca

Self Employed Tax Calculator Business Tax Self Employment Self

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

When Are Taxes Due In 2022 Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Ontario Tax Brackets For 2022 Savvynewcanadians

Income Tax Calculator Estimate Your Refund In Seconds For Free

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Schedule C Income Mortgagemark Com

Tricks For Getting The Biggest Tax Return If You Are Self Employed

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

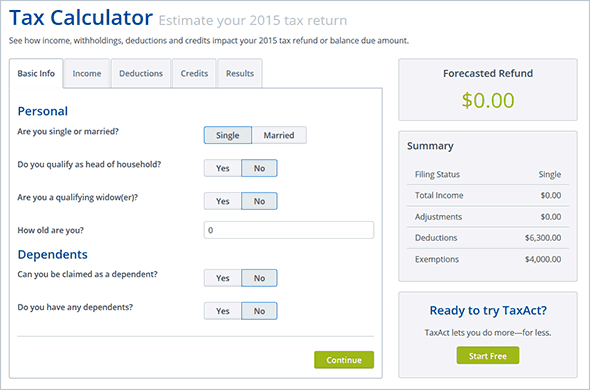

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download